The allure of effortless riches is a powerful siren song. High-yield investments whisper promises of passive income and financial freedom, but often, what glitters isn't gold. The FIAT ETF, with its advertised dividend yield exceeding 100%, presents a compelling case study in this deceptive allure. Is this extraordinary return a genuine opportunity or a precarious gamble? This analysis dives deep into the complexities of the FIAT ETF, examining the evidence, assessing the risks, and providing actionable advice for discerning investors. For more detailed dividend history, see the FIAT dividend data.

Understanding the Enticing, Yet Risky, FIAT Dividend

Imagine a dividend so substantial it surpasses your initial investment. Sounds like a dream, right? The FIAT ETF, with its exceptionally high dividend yield, initially appears to be just that – a dream come true. However, this seemingly lucrative opportunity hides potential pitfalls that demand careful consideration. The exceedingly high yield immediately raises a critical question: Is this sustainable, or is it a temporary anomaly masking significant underlying risks?

The Allure and the Warning Signs

The immediate appeal of the FIAT ETF lies in its generous dividend payouts. This promises a steady stream of income, tempting investors seeking passive income strategies. Yet, this very allure should serve as a warning. Such abnormally high yields rarely persist, often indicating underlying risks that could lead to substantial losses. Why is the yield so dramatically higher than comparable investments? This discrepancy requires thorough investigation.

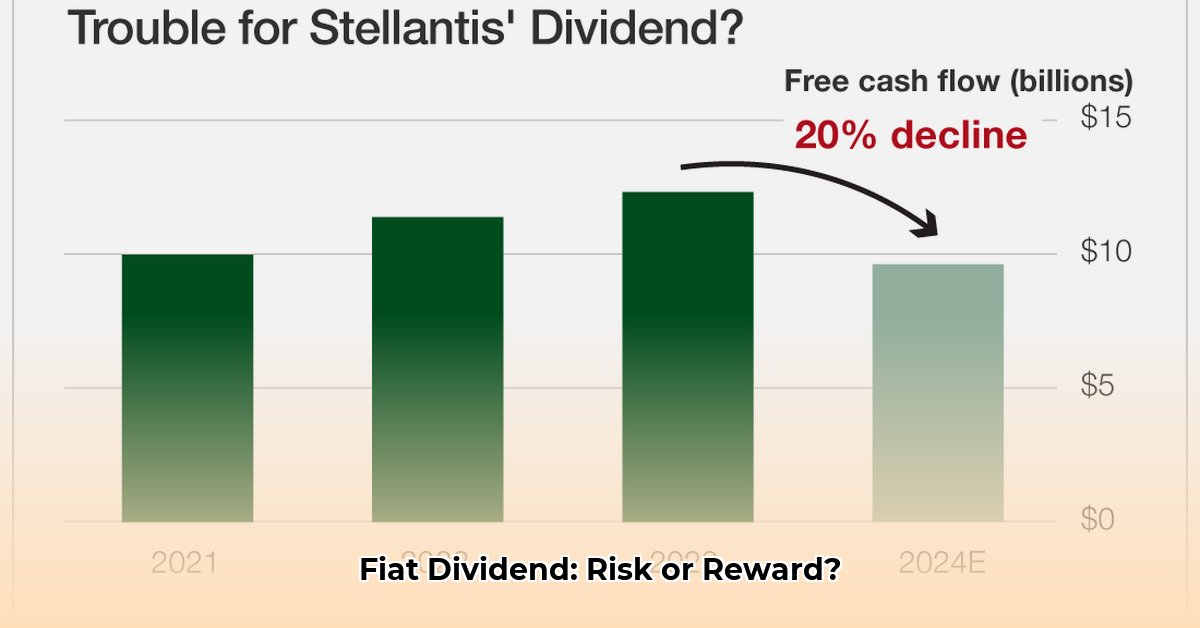

A Volatile Dividend History

The FIAT ETF's dividend history reveals a pattern of extreme volatility. Monthly payouts have fluctuated wildly, creating an unpredictable and unreliable income stream. Witnessing a payout quadruple one month, only to plummet to a fraction of that amount the next, highlights the inherent instability of this investment. Can a stable financial plan be built on such unpredictable returns? The answer, unfortunately, is likely no.

The Opaque Nature of Missing Information

A significant concern surrounding the FIAT ETF is the lack of crucial information, particularly the dividend payout ratio. This metric reveals the proportion of earnings distributed as dividends. Its absence creates a significant information gap, hindering informed decision-making. Investing without this critical data is akin to driving blindfolded; you might reach your destination, but the risk of a catastrophic accident is significantly higher. This lack of transparency is a major red flag, urging caution.

Unpacking the Complex Investment Strategy

The FIAT ETF's name – "Tidal Trust II Yieldmax Short Coin Option Income Strategy" – hints at an intricate and potentially high-risk approach. These options strategies, while capable of generating substantial short-term profits, carry an equally significant potential for rapid and substantial losses. This aggressive strategy might explain the high yield, but it equally explains the high risk inherent in this investment.

Market Dynamics and Their Impact

Past performance is not indicative of future results. The observed data reflects past market conditions, which are inherently dynamic and subject to change. Economic shifts, alterations in investor sentiment, or unforeseen regulatory actions could profoundly impact the ETF's ability to maintain these sky-high dividend payouts. Investors must carefully consider this inherent uncertainty before committing funds.

How to Assess the Risks of a High-Yield FIAT ETF: A Step-by-Step Guide

Before investing in any high-yield instrument, especially one as complex as the FIAT ETF, a systematic risk assessment is paramount. High yields often indicate high risks. Let's define the process and help you avoid potential pitfalls.

Step-by-Step Risk Mitigation

Conduct Thorough Due Diligence: Independently verify all claims and information. Don't rely solely on marketing materials; consult multiple reputable financial sources, and analyze the ETF's prospectus carefully.

Assess Your Risk Tolerance: Honestly evaluate your capacity for loss. High-yield investments generally correspond to higher risk. Are you prepared to potentially lose a substantial portion, or even all, of your invested capital? Invest only what you can comfortably afford to lose.

Seek Professional Financial Advice: Consult a qualified financial advisor. A personalized risk assessment, tailored to your specific financial situation and goals, is invaluable. They can help you analyze your portfolio diversification and mitigate potential risks.

Stay Informed on Regulatory Developments: Keep abreast of any changes in regulations that could impact the ETF or its operations. Regulatory shifts can significantly affect the investment landscape and the viability of your investment.

Risk Assessment Matrix

| Risk Factor | Likelihood | Potential Impact | Mitigation Strategies |

|---|---|---|---|

| Unsustainable Dividend | High | Significant Capital Loss | Diversify Portfolio; Thorough Due Diligence |

| Dividend Fluctuations | High | Income Instability | Assess Risk Tolerance; Consider Alternative Investments |

| Lack of Transparency | High | Poor Decision-Making | Independent Research; Seek Expert Financial Advice |

| Market Downturns | Medium | Capital Losses | Diversification; Strategic Asset Allocation |

| Regulatory Changes | Low | Moderate Impact | Monitor Regulatory News and Potential Changes |

Conclusion: A Cautious Approach

The temptation of high yields is undeniably compelling. However, the FIAT ETF serves as a potent reminder that chasing excessive returns without fully understanding the associated risks can lead to substantial financial losses. The volatility, lack of transparency, and complex investment strategies all point towards a heightened risk profile. Don't let the allure of quick gains overshadow the very real potential for substantial losses. Proceed with extreme caution, or, perhaps, explore alternative investment options that offer a better balance between risk and reward. Remember: in the ever-evolving world of finance, staying informed and seeking expert guidance are crucial for making sound investment decisions.